I. Intake

A. Definitions

Abuse: means infliction of or intent to inflict physical pain or injury on or the imprisonment of any incapacitated adult or resident of a nursing home or other residential facility.

Adult Family Care Home: means a placement setting within a family unit that provides support, protection and security for up to three individuals over the age of eighteen.

Adult Family Care Provider: an individual or family unit that has been certified by the Department of Health and Human Resources, Office of Social Services to provide support, supervision and assistance to adults placed in their home for which they receive payment.

Adult Emergency Shelter Care Home: means a home that is available on a short-term, emergency basis for residential care type clients for whom no other appropriate alternatives currently exist, agreeing to accept placement on a twenty-four (24) hour basis.

Adult Emergency Shelter Care Provider: means an individual or family unit that has been certified by the Department of Health and Human Resources to provide support, supervision and assistance to adults placed in their home at any time on short notice.

Cognitive deficit: means impairment of an individual’s thought processes.

Emergency: means a situation or set of circumstances which present a substantial and immediate risk of death or serious injury to an incapacitated adult.

Incapacitated Adult: means any person who by means of physical mental or other infirmity is unable to independently carry on the daily activities of life necessary to sustaining life and reasonable health.

Neglect: means the failure to provide the necessities of life to an incapacitated adult or resident of a nursing home or other residential facility with the intent to coerce or physically harm such incapacitated adult or resident of a nursing home or other residential facility or the unlawful expenditure or willful dissipation of funds or other assets owned or paid to or for the benefit of an incapacitated adult or resident of a nursing home or other residential facility.

Personal Care Home: A group living facility licensed by the Office of Health Facilities and Licensure and Certification (OHFLAC) providing 24 hour awake supervision of activities of daily living.

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

Personal Care Home Provider: A individual, and every form of organization, whether incorporated or unincorporated, including any partnership, corporation, trust, association or political subdivision of the state licensed by OHFLAC as a Personal Care Home Provider.

Residential Board and Care Home: A group living facility licensed by the Office of Health Facility Licensure and Certification to provide accommodations, personal assistance and supervision for a period of more than twenty four (24) hours to four or more individuals.

Residential Board and Care Home Provider: Any person and every form of organization, whether incorporated or unincorporated, including any partnership, corporation, trust, association or political subdivision of the State licensed by OHFLAC to maintain and operate a RB&C.

Physical deficit: means impairment of an individual’s physical abilities.

B. Introduction and Overview

Personal Care Homes (PCH) are licensed by the Office of Health Facilities Licensure and Certification (OHFLAC). A Personal Care Home must be approved by the State Fire Marshall’s Office before OHFLAC will inspect and issue a license. Specific licensure requirements related to the licensure of Personal Care Homes are contained in OHFLAC regulations 64-14-1. In addition, requirements for the operation of Personal Care Homes are contained in chapter sixteen of the West Virginia Code. The following are some general requirements for these types of providers.

A Personal Care Home is licensed to provide a room and meals, supervision of activities of daily living, and supervision of medications. A PCH may provide limited and intermittent nursing care. This service is a direct hands on nursing care of individuals who require no more than two

(2) hours of nursing care per day for a period of time no longer than ninety (90) consecutive days per episode. Personal Care Homes are licensed for four (4) or more beds. The number of beds a facility is approved for is based on regulations applied to the physical structure of the facility.

Personal Care Homes with ten (10) or more residents must have, at a minimum, one awake staff 24 hours a day. Additional personal care staff must be available as required by OHFLAC in order to provide the care residents require. In addition, a PCH shall not admit a resident in need of extensive or ongoing nursing care. A PCH may not admit a resident if the facility cannot provide the level of care required by the resident.

If a resident has an identified mental or developmental disorder, he or she shall not be admitted for more than four (4) weeks unless the PCH can provide evidence of continued professional

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

follow-up to address the individual’s unique needs in these areas. If, at any time, the resident exhibits symptoms of a mental or developmental disorder, and the resident is not receiving services from a behavioral health agency, the resident shall have up to 30 days to obtain needed services. If it is a emergency situation, the PCH shall seek immediate treatment for the resident.

Residents may receive the services of a licensed hospice provider in addition to the services provided by the PCH. If the resident requires the use of electrically powered equipment (oxygen, suction apparatus, or pumps) the facility must have a backup power generator. Hospice services and intermittent nursing services shall not interfere with the provision of services to other residents.

Physical restraints shall not be used except in an emergency under physician’s order not to exceed twenty four (24) hours for safety of the resident and others in the home. Restraints utilized during emergencies shall be limited to cloth vest or soft belt restraints. Restraints will only be applied by trained staff. Restraints shall be released every two (2) hours for at least ten

(10) minutes. The use of restraints shall be documented and available for review by the Department of Health and Human Resources.

The resident of a PCH has the right to receive visitors and the PCH shall allow access to the resident for the visitors during established visiting hours. The established visitation time shall be twelve (12) hours per day, seven (7) days a week, unless the resident of the PCH has requested otherwise. The PCH must post the visiting hours. Relatives and members of the clergy shall be permitted to visit at any time. Any representative of the State acting in an official capacity shall have immediate access to any resident and the premises of a PCH.

- II.

- Assessment

Since Personal Care Homes (PCH) must be licensed by the Office of Health Facilities Licensure and Certification (OHFLAC), an application to the Office of Social Services to provide PCH services is not required. The social worker must, however, complete all necessary information to set the PCH up as a provider in the FACTS system. Prior to making a placement in a PCH, the Office of Health Facilities Licensure and Certification must be contacted to obtain verification that the facility is appropriately licensed and to obtain the facility license number. A copy of the license may be obtained in lieu of this procedure.

Note: West Virginia Code provides that no public official or employee may place any person in, or recommend that any person be placed in, or directly or indirectly cause any person to be placed in any facility which is being operated without a valid license/certification from DHHR.

Effective June 2001 Page 3 of 46

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

B. Tax Information - W-9

The W-9 information is necessary in order to set a provider up in FACTS. The W-9 must be completed by the provider and submitted to the local DHHR office. The information on the W-9 must be consistent with information reported by the Personal Care Home (PCH) for tax purposes. The original document must be signed in blue ink. If any changes occur, a new W-9 must be completed and resubmitted by the PCH to the local DHHR office. The original is to be forwarded by the local office to the Office of Social Services. The social worker is to retain a copy of the completed W-9 in the provider record in the local office. The location of the hard copy will then be shown in FACTS in “Document Tracking”. A copy of the W-9 is located in the FORMS section of this policy. This form is available on the C:/ drive of your PC as a merge form.

- III.

- Case Management

Licensing regulations for Personal Care Homes include a requirement that staff in these facilities participate in annual training related to the operation and provision of care in this type of facility. Personal Care Home providers who are currently receiving a supplemental payment from the department for a client(s) placed in their facility may be entitled to receive reimbursement for their participation in approved training. This reimbursement is offered as an incentive to encourage providers to participate in relevant training opportunities. Training that would be acceptable in order to qualify for this payment would include training provided by the department or training that is furnished by another agency/entity that has been approved in advance by the Office of Social Services.

Reimbursement to the Personal Care Home for staff participation in training may be made for up to five (5) staff per PCH. In order for the PCH to be eligible to receive this training payment, each individual staff member for whom reimbursement is being requested must attend a minimum of six (6) hours of approved training during the quarter for which reimbursement is being requested. Verification of attendance of the approved training must be submitted at the time reimbursement is being requested. Without verification that training was attended, payment shall not be made.

Upon receipt of the required verification of attendance of at least six (6) hours of approved training during the quarter, the social worker may then prepare a request for a demand payment in the amount of $25.00 each, for up to five (5) staff. The demand payment must be forwarded to the supervisor for approval. The training allowance may not be pro-rated. If a full six (6) hours is

Effective June 2001 Page 4 of 46

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

not completed within the quarter, the individual/PCH is not eligible for this payment. See Provider Training Incentive Payment for detailed information.

B. Payment by the Office of Social Services

Providers of Personal Care Home (PCH) services may receive reimbursement from the department in two ways, automatic payment and demand payment. Reimbursement to the provider for the care and supervision furnished to the client will be done by automatic payment, in accordance with the terms of the Payment Agreement in effect. Demand payments are available for a very limited and specific set of expenses that may occur in the PCH setting.

Personal Care Home providers are paid a flat rate for the care and supervision furnished to each adult placed in the facility by the department. An additional payment of up to $100/month may be made for each individual placed by the department who has been determined to be Hartley eligible. Payment information is calculated in FACTS and is based on information entered by the social worker. Key areas used in calculating the rate of payment include employment information including sheltered employment, income and asset information, debt and expense information, and Hartley eligibility. Complete and accurate documentation in each of these areas is essential in determining the rate of payment. This calculation must be completed before the Payment Agreement can be created.

1. Automatic Payment

Payments to Personal Care Home (PCH) providers for care and supervision furnished will be made by automatic payment. This payment process involves four steps. First, FACTS will calculate the payment to the provider based on the information entered in FACTS about the provider and the client(s) placed in the facility. Second, the PCH provider must prepare and submit a monthly invoice to the Office of Social Services, Financial Unit, identifying each resident for whom reimbursement from the department is being requested. (see PCH Invoicing) Third, the information in FACTS will be compared with the monthly invoice submitted by the provider. The invoice information must match the information in FACTS in order for the payment to be approved. Any discrepancies must be resolved before payment will be approved. Fourth, when the payment information is verified and approved, payment will be mailed to the provider.

To ensure that payments to the provider are accurate and received by the provider without delay, it is essential that the social worker enter the required information in a timely manner. It is equally important that the provider prepare and submit the required invoice by the specified due date, the 5th working day following the month of service.

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

a. Entry/Update of Payment Information

Entry or update of payment information and supervisory approval must be completed in a timely manner in order to avoid delay in payment to the provider. Due dates for entry of information necessary for creation of the Payment Agreement are as follows: C for initial agreements (first time placement) information must be entered and approved by the noon on the fourth (4th) working day of the month;

C for current agreements that are being terminated (eg discharge from the facility) information must be entered and approved by the close of business on the last day of the month in which the change occurred; and,

C for situations that are to be updated effective on a future date (eg SSI increase becomes effective on the 1st day of following month) information must be entered and approved after the 5th working day of the month in which the change becomes effective but by the noon on the last day of that month. For example, if the change in income becomes effective January 1st, the case information must be updated between 12:01 a.m. on the 6th working day of January and noon on the 31st of January.

Information must be entered and/or updated as outlined in order to prevent inaccurate or delayed automatic payment. Payment information that is not entered and approved by the specified date may require a demand payment for the purpose of doing a payment adjustment/correction.

Note: Demand payments to Personal Care Homes for the purpose of doing a corrective payment for room and board may only be made by the Office of Social Services, Financial Unit staff.

b. Payment Agreement

When all necessary information is entered/updated in FACTS, the total rate of payment may be calculated by FACTS and the social worker can create the Payment Agreement. The Payment Agreement will reflect several amounts related to the payment the provider is to receive. These include: C the total monthly rate of payment due to the provider for a full month of care; C the total daily rate due to the provider for a partial month’s care; C the portion of the monthly payment which is to be paid by the client for a full month of

care; C the portion of the daily rate that is to be paid by the client for a partial month’s care; C the portion of the monthly payment, if any, which is to be paid by the department for a

full month of care; C the portion of the daily rate, if any, that is to be paid by the department for a partial month’s care; and, C the amount, if any, the provider must furnish the client for their personal expense allowance.

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

After the Payment Agreement is created based on the information entered in FACTS, the social worker must carefully review the printed document for completeness and accuracy. (See Case Management - Payment Agreement for detailed information about creation of the Payment Agreement.)

Finally, prior to noon on the fourth working day of the month, the social worker must review the monthly payment approval screens in FACTS in order to verify that the payment information in the system and due for release during the next payment cycle is accurate. If there are errors detected, the social worker must make the necessary changes by noon on the fourth working day of the month. If no errors are detected, the social worker must verify the payment shown.

2. Demand Payments

Most costs associated with the care of an adult placed in a Personal Care Home (PCH) will be included in the monthly reimbursement paid to the provider by automatic payment. There are, however, certain specific costs that may be incurred that are not included in that monthly reimbursement. The demand payment process may be used to request reimbursement for certain costs incurred for/on behalf of clients placed in an PCH by the department or for specific expenses incurred by the PCH provider that are not client specific. The need for a demand payment of any type must be determined jointly by the social worker and the provider prior to any cost being incurred and must be reflected in the client’s service plan when the expenditure is client related.

Some demand payment types require a two-tiered approval meaning they must first be approved by the supervisor and then must also be approved by the Office of Social Services. Those payment types that require a two-tiered approval are marked with an (*) in the list below. The demand payment will not be generated by FACTS and sent to the provider until the required approval(s) is done. Only the following demand payment types are permitted: C trial visit (when client does not have resources to pay this cost); C client clothing allowance; C educational expenses for special education students; C *durable medical equipment and supplies; C *non-Medicaid covered services; C *food supplements; C *over-the-counter drugs/DESI drugs or prescriptions not covered by insurance/Medicaid; C co-payment on prescription medications; C provider training incentive payment (not client specific); C *$1,000 incentive payment to provider for their efforts in client’s return home; and, C *other demand payments. Note: Payment adjustments for corrective payments is handled by the OSS Financial Unit.

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

Demand payments are generated on a weekly basis, based on information entered in FACTS by the social worker. Information that is required in order for FACTS to generate demand payments include: 1) information identifying the provider to be paid; 2) client for whom request is being made, if applicable; 3) invoice date; 4) service month; 5) amount to be paid; 6) payment type; and, 7) explanation of why the payment is necessary.

When a demand payment is needed, the social worker must enter the required information in FACTS. The payment information must then be forwarded to the supervisor for approval. Demand payments require supervisory approval. For certain demand payment types, approval by the Office of Social Services is also required in addition to the supervisory approval.

Finally, after the required approval(s) is granted, the social worker must review the payment on the demand payment verification screen to ensure that the amount to be paid to the provider is accurate. If the payment is accurate, verify the payment. If not, identify and resolve the problem(s).

a. Trial Visit

If a client who is currently an active adult services client is planning to move to another home or a different type of setting, a trial placement is recommend to assure a good match between the prospective provider and the client. If an overnight stay is planned as part of a trial visit, the department may reimburse the prospective provider.

If the client is being discharged from an institutional setting or coming from the community and is not an active adult services client at the time of the trial visit, the client must be encouraged to use his/her resources to make payment to the prospective provider. If it is determined that the client does not have resources to pay the provider for the trial visit, the social worker is to request that payment to the provider be made by the department as a demand payment.

Reimbursement made by the department for a trial visit is to be at the current daily rate for the type of provider involved in the trial visit.

b. Clothing allowance

Clients who are placed in residential settings by the department are to have adequate clothing. A clothing allowance is available for adults who are placed in a residential setting by the

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

department and for whom we are making a supplemental payment. The clothing allowance is available at the time of placement and on six (6) month intervals throughout the placement. Requirements related to the use of a clothing allowance include the following: C must be based on the client’s need for clothing; C placement allowance can not exceed $100 and is a one time only allowance; C re-placement allowance can not exceed $75 during a 6 month period; C need for placement or re-placement clothing must be identified and planned for by the

provider and the social worker in advance of purchase; and, C to receive reimbursement by the department, the residential service provider must submit an itemized invoice for the clothing purchased. (See Section III, B, 7 -Clothing Allowance, for detailed information)

c. Educational Expenses for Special Education Students

Adults who are enrolled in special education programming may incur costs associated with their educational program. In order for the department to reimburse the provider for these costs, the adult must be enrolled on a full-time basis in an educational program. In addition, the costs for which reimbursement is requested must not be reimbursable by any other source and must be related to enhancing or completing their educational program. Examples of costs that may be reimbursable include graduation fees and special fees for school trips/functions.

d. Durable Medical

In certain situations the cost of obtaining durable medical equipment or supplies may be reimbursed for adults who have been placed in a Personal Care Home (PCH) by the department and for whom the department is making a supplemental payment. Reimbursement by the department may only be considered after it has been determined by the social worker that there is no other personal or community resource that can meet this need. In addition, the durable medical equipment/supplies for which payment is requested must: C be prescribed by the adult’s physician; C have been deemed medically necessary by the adult’s physician (written statement of

need required); C meet an identified need on the adult’s service plan; C be necessary to prevent the need for a higher level of care; C be a one (1) time only expense rather than a reoccurring cost; C not exceed the current Medicaid rate; and, C not in violation of OHFLAC regulations. In order to request reimbursement for this type of expense, the provider must submit the receipt for the equipment/supplies after the item(s) has been purchased. The social worker must then prepare a request for a demand payment in order to reimburse the provider for the cost incurred. The request must address each of the identified areas. Upon completion of the demand payment request, the social worker must forward the request to the supervisor for approval. This demand

Effective June 2001 Page 9 of 46

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

payment type requires approval by the Office of Social Services in addition to the supervisory approval (two-tiered approval). The demand payment will not be generated by FACTS and sent to the provider until the required approvals are done.

e. Non-Medicaid Covered Services

Clients placed a Personal Care Home (PCH) by the department may, at times, incur expenses that are medically necessary but are not reimbursable by Medicaid. Reimbursement by the department for these costs may only be considered after it has been determined by the social worker that there is no other personal or community resource that can meet this need. In addition, the services for which payment is requested must: C be recommended/authorized by the adult’s medical/mental health professional; C have been deemed necessary by the adult’s medical/mental health professional (written

statement of need required); C meet an identified need on the adult’s service plan; C be necessary to prevent the need for a higher level of care; and, C not if violation of OHFLAC regulations. In order to request reimbursement for this type of expense, the provider must submit the receipt for the services after they have been provided. The social worker may then prepare a request for a demand payment in order to reimburse the provider for the cost incurred. The request must address each of the identified areas. Upon completion of the demand payment request, the social worker must forward the request to the supervisor for approval. This demand payment type requires approval by the Office of Social Services in addition to the supervisory approval (twotiered approval). The demand payment will not be generated by FACTS and sent to the provider until the required approvals are done.

f. Food Supplements

In unique situations, food supplements may be required by an adult placed by the department in a Personal Care Home (PCH) in order to maintain sound nutritional status. In certain situations the cost of obtaining these food supplements may be reimbursed by the department. Reimbursement by the department may only be considered after it has been determined by the social worker that there is no other personal or community resource that can meet this need. In addition, the food supplements for which payment is requested must: C be prescribed by the adult’s physician; C have been deemed medically necessary by the adult’s physician (written statement of

need required); C meet an identified need on the adult’s service plan; C be necessary to prevent the need for a higher level of care; and, C not in violation of OHFLAC regulations. In order to request reimbursement for this type of expense, the provider must submit documentation of the medical necessity and the receipt for the food supplements after they have

Effective June 2001 Page 10 of 46

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

been purchased. The social worker may then prepare a request for a demand payment in order to reimburse the provider for the cost incurred. The request must address each of the identified areas. Upon completion of the demand payment request, the social worker must forward the request to the supervisor for approval. This demand payment type requires approval by the Office of Social Services in addition to the supervisory approval (two-tiered approval). The demand payment will not be generated by FACTS and sent to the provider until the required approvals are done.

g. Over-the-Counter Drugs/DESI Drugs or Rx Not Covered

In certain situations medications may be required by an adult placed by the department in a Personal Care Home (PCH) that are not covered by Medicaid or other insurance. These include items such as over-the-counter medications, DESI drugs, or other prescription medications that are medically necessary but not covered by insurance. The cost of these medications may be reimbursed by the department. Reimbursement by the department may only be considered after it has been determined by the social worker that there is no other personal or community resource that can meet this need. In addition, the medications for which payment is requested must: C be prescribed/ordered by the adult’s physician; C have been deemed medically necessary by the adult’s physician (written statement of

need required); C meet an identified need on the adult’s service plan; C be necessary to prevent the need for a higher level of care; and, C not in violation of OHFLAC regulations . In order to request reimbursement for this type of expense, the provider must submit the receipt for the after they have been purchased. The social worker must then prepare a request for a demand payment in order to reimburse the provider for the cost incurred. The request must address each of the identified areas. Upon completion of the demand payment request, the social worker must forward the request to the supervisor for approval. This demand payment type requires approval by the Office of Social Services in addition to the supervisory approval (twotiered approval). The demand payment will not be generated by FACTS and sent to the provider until the required approvals are done.

Note: DESI Drugs (Drug Efficiency Study Implementation) - These are older drugs that have since been replaced by newer versions and are now considered to be “ less than effective”. In some situations, however, an individual can not tolerate the newer versions of the drugs or experience higher degree of side effects and the physician chooses to continue prescribing the older version of the drug.

h. Co-Payment on Prescription Medications

The cost of required co-payments for medications may be reimbursed for adults who have been placed in a Personal Care Home (PCH) by the department and for whom the department is

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

making a supplemental payment. Reimbursement by the department may only be considered after it has been determined by the social worker that there is no other personal or community resource that can meet this need. In addition, the medications to which the co-payment applies and for which payment is requested must: C be prescribed by the adult’s physician; C have been deemed medically necessary by the adult’s physician; C meet an identified need on the adult’s service plan; and, C be necessary to prevent the need for a higher level of care; In order to request reimbursement for this type of expense, the provider must submit documentation of the medical necessity of the medications and the receipt for the required medications after they have been purchased. The social worker must then prepare a request for a demand payment in order to reimburse the provider for the cost incurred. The request must address each of the identified areas. Upon completion of the demand payment request, the social worker must forward the request to the supervisor for approval.

i. Provider Training Incentive Payment

Personal Care Home (PCH) providers who are currently receiving a supplemental payment for a client(s) placed in their facility by the department are entitled to receive reimbursement for approved training they receive. This reimbursement is offered as an incentive to encourage providers to participate in relevant training opportunities to enhance their skills and knowledge as PCH providers. Training that would be acceptable in order to qualify for this payment would include training provided by the department or training that is furnished by another agency/entity that has been approved in advance by the department. This reimbursement is available for up to five (5) designated staff.

In order to be eligible to receive this training payment, each staff member for whom reimbursement is being requested must attend a minimum of six (6) hours of approved training during the quarter for which reimbursement is being requested. The quarters to be used for determining this allowance are based on the calendar year. Specifically, the quarters to be used are January - March; April - June; July - September; and October - December. Upon completion of the required hours of approved training, the provider may request payment of the training allowance by the department. Verification of attendance of the approved training must be submitted at the time reimbursement is being requested. Acceptable verification must include, at a minimum, training topic, name and title of the presenter, date(s) of training, and duration of the training session. Without verification that training was attended, payment shall not be made.

Upon receipt of the required verification of attendance of at least six (6) hours of approved training for each individual for whom reimbursement is being requested during the quarter, the social worker may then prepare a request for a demand payment in the amount of $25.00 each,

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

for up to five (5) staff. Upon completion of the demand payment request, the social worker must forward the request to the supervisor for approval.

Note: The training allowance can not be prorated. If a full six (6) hours of training is not completed by an individual within the quarter, the provider is not eligible for this payment for that individual.

j. $1,000 Incentive Payment

The intent of this incentive payment is to reward a Personal Care Home (PCH) that has been primarily responsible for a client improving to the point that they no longer required residential care services and consequently can return to their own home to live. This payment is not intended to provide additional compensation for providers who have provided short term care to clients with short term needs.

In order to qualify for this payment, a provider must be nominated by the social worker. For a provider to be considered for nomination to receive this incentive payment, all the following criteria must be met: C the client must have been income eligible and the provider having received a monthly

supplemental payment from the department for the service they rendered (private pay clients are not to be considered); C the provider must have provided full time care to the client for a minimum of twelve consecutive months;

C a multi-disciplinary team, such as a Community Planning Team (CPT) used with guardianship cases, must have been involved in the establishment of the goal of independent living and the development/monitoring of the service plan that was implemented;

C independent living must have been the planned objective on the client’s Service Plan and progress toward the achievement of this goal should be well documented in the six (6) month case review;

C the provider must have been assigned, as part of the Service Plan, key/measurable tasks toward the achievement of the client’s goal of independent living; C the social worker must be able to demonstrate that the client’s return to the level of independence was primarily due to the efforts of the provider; C an aftercare plan must be in place to identify the tasks to be accomplished, and by whom, during the six (6) month period the client is living in their own home; and C once the client has returned to their home, they must remain there independently for at

least six (6) months before this incentive payment can be approved. Close communication between the local staff and the Office of Social Services is encouraged throughout this very involved procedure. When a client is first identified as a possible candidate for independent living, the social worker will need to consult with their supervisor. If it is agreed

Effective June 2001 Page 13 of 46

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

that the provider has identified a potential nominee, the social worker is to notify the Office of Social Services of their intention to proceed. An appropriate Service Plan must be developed with the goal of independent living and the specific tasks assigned to the provider in accomplishing this goal clearly identified. Regular monitoring of the progress being made by the client toward the achievement of the established goal of independent living is to be documented by the social worker. Upon completion of the six (6) month case review, an update regarding the status of progress must be forwarded to the Office of Social Services.

If supportive services are required once the client goes home, an aftercare plan must be developed to identify what services are to be provided and who will be responsible for the provision of those services. The social worker must continue to provide case management services for at least six (6) months after the client’s return home. Follow-up during this period of time must include, at a minimum, monthly monitoring visits. If more frequent monitoring is required, this should be evaluated carefully as it may be an indication that the case may not be stable and the client may need to return to a more supportive type of setting. (Note: the client’s placement is to be end dated upon discharge from the PCH to home, however, the case is to remain open as an Adult Residential case in FACTS during the six (6) month aftercare period so contacts and progress can be documented.)

If, at the end of the six (6) month aftercare period the client is able to continue to live independently, the worker must prepare a request for payment of the $1000.00 provider bonus. Upon completion, the request must be submitted to the supervisor for approval. At a minimum, the request must include the following: C the date the client went into placement with the provider; and, C adequate documentation/justification to support the provider’s eligibility to receive the

bonus, based upon each of the criteria listed above. If the supervisor concurs with the worker’s recommendation that the provider is eligible to receive this special compensation, the request is then to be forwarded, to the Adult Services Unit of the Office of Social Services for consideration and approval. Once approval of both the supervisor and the Office of Social Services has been obtained, a demand payment may be issued by the department. In addition to the payment, the local office is encouraged to send a letter of commendation to the provider recognizing them for their efforts.

k. Other Demand Payment - Not Specified

In certain situations, the cost of obtaining needed supplies or services other than those payments specifically identified as a demand payment type may be reimbursed for adults who have been placed in a Personal Care Home (PCH) by the department and for whom the department is making a supplemental payment. Reimbursement by the department may only be considered after it has been determined by the social worker that there is no other personal or community resource that can meet this need. In order for the department to reimburse the provider for these costs, the provider must

Effective June 2001 Page 14 of 46

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

submit receipts for the costs incurred. Examples of costs that may be reimbursable include legal expenses, conservator fees, etc. This demand payment type requires approval by the Office of Social Services in addition to the supervisory approval (two-tiered approval). The demand payment will not be generated by FACTS and sent to the provider until the required approval(s) is done.

3. PCH Invoicing

In order for payment to Personal Care Homes to be approved, the provider is required to submit a monthly invoice which then must be reconciled against the payment information in FACTS. The following requirements and procedures apply to this invoicing process.

General Requirements & Information:

The Personal Care Home (PCH) must submit a monthly invoice in order to receive payment from the department. Payment will not be made without an invoice (see FORMS for sample PCH invoice). The invoice is to include all adults for whom DHHR is making a payment. Residents for whom the department is NOT making a supplemental payment are NOT to be included on the invoice.

A sample invoice has been developed for providers to use for this purpose. Use of this form is optional. The PCH may use the sample invoice provided or use one of their own as long as all required information is included. Invoices must be submitted by the 5th working day of the month following the service month. Providers should check invoices carefully prior to submission since late, incomplete or inaccurate information could result in a delay in payment. Payments are automatic based on info entered in FACTS BUT must be approved by OSS financial unit before payment will be made. This approval is based on a comparison of the invoice information with the information in FACTS.

Invoicing Procedures:

An original invoice must be submitted by the provider to the Office of Social Services, Financial Unit, by the 5th working day of month following service provision. A faxed invoice is not acceptable. The invoice must be on the agency’s letterhead or the sample form provided and must include the following information, at a minimum:

Provider Information: C official name of provider as used on their federal income tax reporting, C provider mailing address (where reimbursement is to be mailed), C provider identification # (assigned by DHHR),

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

C provider representative to be contacted if there are questions about the invoice (name & phone #), C statement certifying that info is true and accurate and that the invoice is original and that payment has not been received, and C original signature of person authorized by provider to sign invoices

Client Information

C name of each client who has been placed by the department and for whom reimbursement by the department is being requested, C for each client invoiced

- -

- date of admission and indication if this is a new admission during the billing month

- -

- total number days in care during the month

billing month, daily rate x the number of days in care if the client was in placement for a partial month)

Note: For partial month placements, the day of placement is counted, day of discharge is not counted.

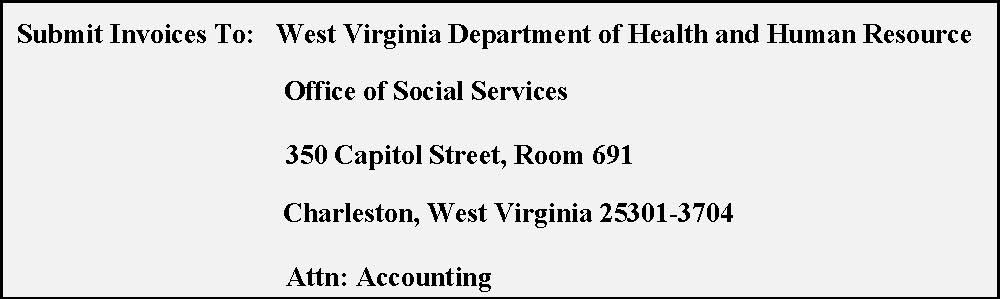

Department Information

C name and phone number of the DHHR social worker who manages that provider and placements made there, and C Invoices are to be submitted to the Office of Social Services, 350 Capitol Street, Room 731, Attn: Financial Services Unit

Verification & Approval of Payments:

The Office of Social Services (OSS), Financial Unit staff is responsible for verification of invoice information and approval of payment to Personal Care Homes. This approval is accomplished by comparing information on the invoice with information in FACTS. Information is verified and payments approved client by client. If information on the invoice matches the information in FACTS, payment will be approved. If information DOES NOT match, the social worker will be contacted to resolve the problem area(s). When next automatic payment is generated, payment for all approved clients will be made. Any clients for whom payment has not been approved will not be included in the automatic payment to the provider. When the problem(s) are resolved, a demand payment is to be requested by OSS Financial Unit staff to reimburse the provider for the care provided to the client.

Adult Services Staff Responsibilities

C talk with providers about the invoicing procedures;

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

C provide additional clarification, answer questions as needed;

C ensure that applicable information in FACTS is accurate and current including but not limited to verification of the accuracy of payment information in FACTS prior to the scheduled payment run; and,

C assist financial staff in resolving invoicing/payment errors upon request.

Personal Care Home Provider Responsibilities

C prepare and submit monthly invoice; C submit corrected invoice if error in invoice is identified; and, C advise department of any payment errors.

Office of Social Services Financial Unit Staff Responsibilities

C reconcile monthly invoice information with information in FACTS (client-by-client); C if no errors found, approve payment for the client; C if error(s) found, notify social worker of problem identified and request assistance as

appropriate; C when error is resolved, approve payment; and, C request corrective payment if applicable.

4. Bed Hold

There may be times when an adult who has been placed in a Personal Care Home by the department must be out of the facility for a brief period of time for inpatient treatment, inpatient hospitalization, or scheduled client social activities. The intent of the bed hold is to ensure the availability of a bed and to prevent disruption of a stable placement whenever possible and appropriate.

A bed hold shall not automatically be granted. Determination of whether a bed hold is appropriate shall be made based on the unique circumstances of the case. Specific time frames apply depending on whether the bed hold is for medical/treatment purposes or social purposes.

a. Medical A bed may be held for a resident for up to fourteen (14) days per episode when it is necessary for the client to be absent from the home for inpatient hospitalization/treatment. Payment at the established rate will continue for up to fourteen (14) days, or until such time it is determined that the client will not be returning to the home not to exceed the fourteen (14) day limit. Payment by the department and/or the client will continue in accordance with the terms of the Payment Agreement in effect. If it is determined that the resident will not be returning to the home, the social worker must end date the Payment Agreement and advise the provider. In order to grant a bed hold for medical treatment purposes, all the following criteria must be met:

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

| C | the provider must notify the department of the adult’s need for out-of-home treatment (in |

| advance whenever possible, the next working day whenever out-of-home care is required on | |

| an emergency basis); | |

| C | the adult for whom payment is being continued was placed in the facility by the department |

| and the department is currently making a supplemental payment for their care; | |

| C | the adult’s absence from the Personal Care Home is to be temporary and short-term, not to |

| exceed 14 days per episode; | |

| C | the resident is expected to continue to be appropriate for placement in a Personal Care upon |

| discharge from treatment/hospital; and, | |

| C | the resident will be returning to the Personal Care Home upon discharge. |

| b. | Social |

Providers are to encourage residents to engage in appropriate social and recreational activities. Examples include: natural family visitation, natural family vacations, specialized camps, overnight field trips, etc. A client may be absent from the home for these types of events for up to fourteen (14) days per calendar year. During the resident’s absence, the Personal Care Home provider will continue to receive payments uninterrupted. In order to grant a bed hold for social purposes, all the following criteria must be met: C the activity must be scheduled in advance and reflected in the client’s service plan; C the adult for whom payment is being continued was placed in the facility by the department

and the department is currently making a supplemental payment for their care; C the adult’s absence from the Personal Care Home is to be temporary and short-term, not to exceed 14 days per calendar year; and, C the resident will be returning to the Personal Care Home.

C. Reviews

1. By OHFLAC

After the initial license is issued, OHFLAC requires a renewal application annually. The new application must be submitted by the Personal Care Home (PCH) ninety (90) days prior to the expiration date appearing on the current license. In addition, OHFLAC may review the PCH more frequently as needed . The inspection by OHFLAC is to be conducted by one (1) or more individuals who are competent to investigate health needs, life safety issues, and behavioral needs. The team members are required to inspect and review all regulatory requirements. In addition, the State Fire Marshall’s Office may inspect the PCH yearly. A copy of the OHFLAC review is to be made available to residents and the ombudsman, upon request. This report is public information, however, the names of all residents must remain confidential

2. By the Office of Social Services

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

Personal Care Homes do not require a formal review by Social Services. At least annually, however, the assigned social worker shall document that the Personal Care Home (PCH) has a current license. This may be done by viewing the license and making a copy or by contacting OHFLAC for verification. Licensure status must be documented in FACTS. As part of the review process, the social worker may document their observations and opinions regarding the quality of care provided by the PCH. In addition, the social worker must indicate if any Adult Protective Service referrals were received and the disposition of the referrals.

In the event a situation should be observed during the review process that would raise a question about the quality of care provided, the social worker is to notify OHFLAC in writing. In certain circumstances the social worker may also request that the provider complete a Corrective Action Plan. This would be appropriate in situations where the social worker identified 1) a situation(s) that is serious enough for OSS to consider restricting placement to the facility, 2) misuse of personal expense allowance, 3) restriction of services as “punishment”, 4) inadequate supervision, etc.

When a situation(s) is identified that would require corrective action, verbal notification is to be given to the provider during the review. Verbal notification should include identification of the specific problem area(s) noted. Written notification of the identified problem area(s) is to be done using the Adult Residential Services (ARS) Corrective Action Letter. This letter is to be sent to the provider within seven (7) calendar days of the verbal notification. The problem area(s) to be corrected are to be listed and a time frame for the completion of the corrections specified, not to exceed thirty (30) days from receipt of the verbal notification. The ARS Corrective Action Letter is available as a FACTS merge form and may be accessed through the hard drive of your PC (C:\). The social worker must file a copy of the letter in the provider’s paper record, and record in document tracking where the copy of the original signed document is located.

D. Complaints

When a complaint is received involving a Personal Care home (PCH), the complaint will be reviewed by the supervisor to determine if it is Adult Protective Services in nature. If the complaint is determined to be Adult Protective Services in nature, it will be assigned for further action. If the information received is concerning licensure issues, the person calling in the complaint will be requested to contact OHFLAC. If the individual refuses, a written report must be sent to OHFLAC and the Long Term Care Ombudsman by social service staff.

E. Reports

1. Payment Agreement

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

The Payment Agreement, which is completed during the case management phase of the case work process, is the document which sets forth the terms of payment for placement in the Personal Care Home (PCH). Within this document, the following information is specified: 1) the payment amount due to the provider, 2) the portion of payment to be paid by the client, and 3) the portion of the payment to be paid by the department. The agreement further identifies the monthly rate (for a full month of placement) and the daily rate (for a partial month of placement). Finally, the agreement identifies the amount that is to be available to the client as their personal expense allowance and whether the client is to retain this amount from their funds or if the provider if to furnish this amount from their reimbursement by the department. The Payment Agreement is created by FACTS based on information entered by the social worker. After all required documentation has been completed, the Payment Agreement must be printed and required signatures obtained.

This form is available as a DDE in FACTS and may be accessed through the report area. It may be opened as a WordPerfect document, populated with information that has been entered in FACTS. The social worker then has the ability to make modifications, as appropriate, before printing the document. The completed document must then be saved to the FACTS file cabinet for the case. Creation of this form must be documented in the document tracking area of FACTS. Finally, after printing the Payment Agreement the worker must secure all required signatures, provide the client and all signatories with a copy, file the original signed document in the client case record (paper record), and record in document tracking where the original signed document is located. A copy of this form is available in the FORMS section of this policy.

Note: The social worker must review the Payment Agreement carefully to insure the accuracy of the information. Particular attention should be paid to the facility type and payment amounts reflected on the document.

2. Resident Agreement for Participation

The Resident Agreement for Participation, which is completed during the case management phase of the case work process, is an agreement that the social worker completes with the client being placed in a Personal Care Home (PCH) that specifies certain requirements that the client agrees to abide by while in placement. This form is available as a FACTS merge document and may be accessed through the hard drive of your PC (C:\). Finally, after printing the Resident Agreement for Participation, the social worker must secure the required signature, provide the client and provider with a copy, file the original signed document in the client case record (paper record), and record in document tracking where the original signed document is located. A copy of this form is available in the FORMS section of this policy.

3. Hartley Verification Letter

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

This letter is to be used to obtain written verification of eligibility as a Hartley class member for an individual who has been placed in a Personal Care Home (PCH). Completion of this verification in a timely manner (at the time of placement or shortly thereafter) is essential since verified Hartley eligibility does effect the amount of payment due to the provider. This letter is to be sent to the appropriate agency to be completed. It is available as a FACTS merge document and may be accessed through the hard drive of your PC (C:\). A copy of this form is also available in the FORMS section of this policy.

4. Service Plan

The Service Plan is completed in the case management phase of the case process. This form is available as a DDE in FACTS and may be accessed through the report area. It may be opened as a WordPerfect document, populated with information that has been entered in FACTS. The social worker then has the ability to make modifications, as appropriate, before printing the document. The completed document must then be saved to the FACTS file cabinet for the case. Creation of this form must be documented in the document tracking area of FACTS. Finally, after printing the service plan the worker must secure all required signatures, provide the client and all signatories with a copy, file the original signed document in the client case record (paper record), and record in document tracking where the original signed document is located. A copy of this form is available in the FORMS section of this policy.

5. Sample PCH Invoice

The Personal Care Home (PCH) must submit a monthly invoice in order to receive payment from the department. Payment will not be made without an invoice (see FORMS for sample PCH invoice). The invoice is to include all adults for whom DHHR is making a payment. Residents for whom the department is NOT making a supplemental payment are NOT to be included on the invoice. A sample invoice has been developed for providers to use for this purpose. Use of this form is optional. The PCH may use the sample invoice provided or use one of their own as long as all required information is included. For detailed information, see the section of this policy titled PCH Invoicing.

6. Social Evaluation

This form is used to provide information to the provider concerning the client. Information included on the form is identifying information, activities of daily living (ADL) functioning capacity, medications, characteristics, formal and informal support systems. This form is available as a FACTS merge document and may be accessed through the hard drive of your PC (C:\). The social

Effective June 2001 Page 21 of 46

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

worker must file a copy of the document in the provider record (paper record) and record in document tracking where the original document is located. A copy of this form is available in the FORMS section of this policy.

7. Adult Residential Services Corrective Action Letter

The Corrective Action Letter is to be issued after the provider has been verbally notified of deficiencies. Deficiencies may be identified either: 1) during the regularly scheduled annual review or 2) at any other time that deficiencies are observed. This letter is to be sent to the provider within seven (7) calendar days of the verbal notification. The deficiencies to be corrected are to be listed and a time frame for the completion of the corrections specified. This for is available as a FACTS merge form and may be accessed through the hard drive of your PC (C:\). The social worker must file a copy of the letter in the provider’s paper record, and record in document tracking where the copy of the original signed document is located.

8. Negative Action Letter

Any time a negative action is taken in involving a Personal Care Home (PCH), such as provider case closure or a restriction of placements, etc., the provider must be furnished with written notification of the action being taken. The negative action taken must be clearly and specifically stated, advising the provider of the action being taken and the reason(s) for the action. In addition to notification of the negative action, the provider must be made aware of their right to appeal the decision and advised of what they must do to request an appeal. A form letter titled “Notification Regarding Application for Social Services” (Negative Action Letter) is to be used for this purpose. This form is available as a FACTS merge document and may be accessed through the hard drive of your PC (C:\). A copy of this form is also available in the FORMS section of this policy. (See Common Chapters for specific information regarding grievance procedures.)

9. W-9

The W-9 information is necessary in order to set a provider up in FACTS. The W-9 must be completed by the provider and submitted to the local DHHR office. The information on the W-9 must be consistent with the information reported by the PCH for tax purposes. The original document must be signed in blue ink. If any changes occur, a new W-9 must be completed and resubmitted by the PCH to the local DHHR office. The original is to be forwarded by he local office to the Office of Social Services, attention Director of Administrative Services. The social worker is to retain a copy of the completed W-9 in the provider record in the local office. The location of the hard copy will be shown in FACTS in “document tracking”. A copy of the W-9 is located in the FORMS section of this policy. The form is available as a merge form of the hard drive of your PC (C:\). A copy of this form is available in the FORMS section of this policy.

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

F. Record Keeping

Upon placement of a client in the Personal Care Home (PCH) or shortly thereafter, information about the client and his/her needs is to be given to the provider by the social worker. The provider is to establish a file for each individual placed in their home and maintain all information about the client for reference as needed. Information that must be given to the provider by the social worker and maintained in the client file by the provider includes the following information.

Client Information

C identifying information about the client; C information about significant others such as family members, friends, legal representatives,

etc.; C information about the client’s interests, hobbies and church affiliation; C medical status including current medications, precautions, limitations, attending physician,

hospital preference; C advance directive(s) in force; C information about client’s burial wishes, plans and resources;

Note: The Social Evaluation must be used for this purpose. This form is available as a FACTS merge document and may be accessed through the hard drive of your PC (C:\)

Client Documents

C copy of the signed Resident Agreement for Participation; C copy of the current and all previous Payment Agreements; and, C copy of the current service plan;

All other information received by the provider that is specifically related to the client is to be maintained in the provider’s client file. This applies to information provided by the social worker as well as information from other sources.

- IV.

- Closure

A final evaluation must be completed as part of the review process prior to closure of the Personal Care Home (PCH) for use by the Office of Social Services (OSS). Upon completion, the social worker must document the results of this assessment in FACTS, including the reason(s) closure is

Effective June 2001 Page 23 of 46

Social Services Personal Care Homes Manual Request to Provide Services Chapter 35,000

being recommended. The completed review is then submitted to the supervisor for approval of recommendation for closure. Upon supervisory approval, the facility’s provider record is to be closed as a provider of PCH services.

B. Notification of Provider Closure

If the Personal Care Home (PCH) is closed as an OSS provider, written notification to the provider is required. A form letter titled “Notification Regarding Application for Social Services” (Negative Action Letter) is to be used for this purpose. This form is available as a FACTS merge document and may be accessed through the hard drive of your PC (C:\). A copy of this form is also available in the FORMS section of this policy

C. Provider’s Right to Appeal

A provider has the right to appeal a decision by the department at any time for any reason. To request an appeal, the provider must complete the bottom portion of the “Notification Regarding Application for Social Services” (Negative Action Letter) and submit this to the supervisor within thirty (30) days following the date the action was taken by the department. The supervisor is to schedule a pre-hearing conference to consider the issues. If the provider is dissatisfied with the decision rendered by the supervisor, the appeal and all related information is to be forwarded by the supervisor to the hearings office for further review and consideration. (See Common Chapters for specific information regarding grievance procedures.)

V. Forms

Form - A Payment Agreement

PAYMENT AGREEMENT

, -- has been approved for Personal Care Home

| (client name) | (social security #) | |||||||

|---|---|---|---|---|---|---|---|---|

| placement in | at | |||||||

| (provider name) | (provider address) | |||||||

| effective | . | The total rate of payment for room, board and supervision is | ||||||

| established at $ | for a full month or $ | per day for a partial month placement. The client | ||||||

currently has benefits in the amount of $ per month that are available to be applied toward their cost of care. The client’s available resources are to be distributed as follows: $ per month to the client for their personal expense allowance and payment to the provider by the client in the amount of $ per month for a full month of care or $ per day for a partial month of care. The Department of Health and Human Resources will make a monthly supplemental payment to the provider in the amount of $ for the balance of the client’s monthly cost of care. This payment, made to the provider is to be distributed as follows: $ per month to be received by the client for their personal expense allowance and payment retained by the provider in the amount of $ per month for a full month of care or $ per day for a partial month of care.

The client and Department of Health and Human Resources agree to pay the provider, as specified above. This payment is to cover the cost of room, board, and personal services for the period of time the client remains in the provider’s home or until such time as the client’s situation changes, which may require that a new contract be developed in accordance with the policies of the Department of Health and Human Resources. The full monthly rate is due and payable to the provider for each month the client is in placement for an entire month. The specified daily rate shall apply for each day, excluding the day of discharge, that the client is in placement for less than a full month. The provider agrees to provide room, board, personal care and supervision to the client at the rate indicated above.

It is the understanding of all parties that this agreement may be terminated by the client, the provider or the Department of Health and Human Resources in accordance with applicable agency policy.

* Note: Daily per diem is calculated as follows: monthly rate x 12 months ÷ 365 days = daily rate

Client Signature: Date: Provider Signature: Date: Social Service Worker: Date:

DHHR Supervisor: Date:

Form - B Resident Agreement for Participation

WEST VIRGINIA DEPARTMENT OF HEALTH AND HUMAN RESOURCES ADULT RESIDENTIAL SERVICES RESIDENT AGREEMENT FOR PARTICIPATION

I, , have applied for participation in the Adult (client name)

Family Care/Residential Board & Care/Personal Care Home program.

As a participant in the program, I agree:

- To make a monthly payment to the provider in accordance with the payment agreement;

- To inform the provider before inviting any friends or relatives to the home;

- To inform the Department of Health and Human Resources and the provider immediately of any changes in my income and/or living arrangements in order to prevent delay or error in payment;

- To make restitution in the event there is an error in payment as a result of my failure to immediately inform the Department of Health and Human Resources and the provider of any changes;

- To become familiar with and abide by the provider’s house rules and regulations;

- To use my personal expense allowance as I choose so long as it is consistent with the provider’s house rules;

- To permit the provider to share relevant information about me with the West Virginia Department of Health and Human Resources staff, my physician, and other agencies/service providers so long as sharing of this information is in my best interest; and

- To show respect for the provider, other residents and other family members in the home.

(Resident/Legal Representative Signature) (Date)

(Social Worker Signature) (Date)

Form - C Hartley Verification Letter

| STATE OF WEST VIRGINIA | ||

|---|---|---|

| DEPARTMENT OF HEALTH AND HUMAN RESOURCES | ||

| Cecil H. Underwood | Bureau for Children and Families | Joan E. Ohl |

| Governor | Secretary | |

(date)

TO:________________________________________

________________________________________

________________________________________ Re:________________________________

(Client name)

Dear _______________________________________:

We are trying to determine if the individual named above meets the criteria to qualify as a Hartley Class member and therefore, eligible for additional funding to help pay for their care. To do this, we will need written verification from you indicating if this individual falls into one or more of the categories listed below. Please mark the appropriate category(ies), sign/date the verification and return the completed form to me at the address indicated below.

RELEASE OF INFORMATION

To whom it may concern:

I, ______________________________________________, do authorize________________________________________ to release the following information to the West Virginia Department of Health and Human Resources. I understand that this information will be used to assist in the determination of my eligibility to be included as a class member under the Hartley Decision.

signature:_________________________________________________

date:_________________________________________________

VERIFICATION OF HARTLEY ELIGIBILITY (Mark all that apply)

The above named individual:

_____ is currently an active case with my office/agency and receiving mental health services;

_____ has been assessed and does meet the OBHS diagnostic and functional impairment criteria for targeted case management, clinic, or rehabilitation services;

_____ has a diagnosis of mental illness, substance abuse, or developmental disability and has at some point in the past received treatment at a state operated facility (Colin Anderson Center, Greenbrier Center, Huntington Hospital, Weston Hospital, Sharpe Hospital, Lakin [psychiatric] Hospital or Spencer Hospital.);

Hartley Verification Letter Page 2 Date Sent:______________________________________ Client Name:____________________________________

_____ is not eligible under the Hartley criteria; or

_____ Other/Comment:_______________________________________________________________________________

signature:_________________________________________________ title:_________________________________________________ date:________________________________________________

Thank you for your anticipated cooperation in this matter. Please return the completed form to the following address:

Return To:

Sincerely, Social Worker:_____________________________________________ Title:____________________________________________________ Phone#/ext:_______________________________________________

Form - D Service Plan

Adult Services Service Plan

(Revised September 1999)

Client Name: FACTS Case #: Date Initiated: Date Reviewed:

| Problem/Need Statement | Goal | Task/Service | Responsible Party | Frequency | Duration | Goal Begin Date | Estimated Completion Date |

|---|---|---|---|---|---|---|---|

Client Signature Date Provider Signature Date Worker Signature Date Supervisor Signature Date

Form - E Sample PCH Invoice

| (Provider Letterhead) INVOICE | Page __________ of __________ | |

|---|---|---|

| PERSONAL CARE HOME SERVICES | ||

| Provider Name: | Provider #: | |

| Mailing Address: | Phone #: Contact Person: | |

| DHHR Social Worker: | Month/Year of Service: Phone #: | / |

| Client Name | SSN | Date of Admission | Date of Discharge | Approved Monthly Pmt. Rate due from DHHR | Approved Daily Pmt. Rate due from DHHR | Period Invoiced | Total Amount Invoiced | |

|---|---|---|---|---|---|---|---|---|

| Full mo. | # Days | |||||||

Provider Name: Provider #:

Month/Year of Service: / Page of

| Client Name | SSN | Date of | Date of | Approved | Approved | Period Invoiced | Total Amount | |

|---|---|---|---|---|---|---|---|---|

| Admission | Discharge | Monthly Pmt. Rate due from DHHR | Daily Pmt. Rate due from DHHR | Invoiced | ||||

| Full mo. | # Days | |||||||

| # Admissions this month: | # Discharges this month: | Total Amount Invoiced: | ||||||

I hereby certify that the information above is true and accurate. I further certify that this is an original invoice and that no payment has been received.

Date:

Signature:

Title:

Form F Social Evaluation

WEST VIRGINIA DEPARTMENT OF HEALTH AND HUMAN RESOURCES SOCIAL EVALUATION

I. IDENTIFYING INFORMATION

A. Client Name B. Marital Status

C. Current Address D. Religious Preference

E. F. Social Security #

G. Date of Initial Request

H. Relative or Other Contact Person

I. Attending Physician (name) (address) (telephone #)

J. Burial plans

K. Medical and/or Life Insurance

| Name of Company | Policy Number | Face Value |

|---|---|---|

II. SOCIAL EVALUATION

A. Explanation of why services are being requested at this time:

B. Worker’s Assessment of the Client’s Functional Capacity (check all that apply)

1. AMBULATION Independent Ambulates with a devise Ambulates with help of another person

2. MENTAL/COGNITIVE CONDITION Alert Irrational Behavior Diminished mental awareness

Up in chair - transfers independently Confused

Up in chair - dependent to transfer Comatose Bedridden Comments: Comments:

3. EATING 4. BOWEL/BLADDER CONTROL Eats independently Completely continent Feeds self with help Partially incontinent Must be fed Catheter in use Comments: Incontinent

Comments:

5. MEDICATIONS: Self-Administered Yes No (list each) Name of Medication Dosage Frequency Prescribing Physician

| Bathing | |||

|---|---|---|---|

| Dressing | |||

| Care of Home | |||

| Food Preparation (Including purchasing) |

| 7. | INDIVIDUAL CHARACTERISTICS | ||||

|---|---|---|---|---|---|

| a. Temperament - Personality Traits | |||||

| b. Employment History | |||||

| c. Education | |||||

| d. Recreation, Hobbies and Interests | |||||

| C. | HABITS | ||||

| (1) Tobacco | (2) Alcohol/Drugs) | (3) Food | (4) Sleeping | (5) Personal Hygiene | |

| Comments: | |||||

D. SPECIAL DISABILITIES (Check all that apply)

| Impaired Vision | Paralysis | Amputation | |||

| Blind | Speech Impair. | Fractures | |||

| Deaf | External Ulcers | Deformities | |||

| Other (specify) | Other (specify) | Other (specify) |

E. FORMAL/INFORMAL SUPPORT(S) AND LIVING ARRANGEMENTS Explain relationships; ability of relatives, friends, neighbors to assist client. Also explain client’s refusal to receive services when appropriate.

III. ASSESSMENT OF TYPE CARE/SERVICES NEEDED (check all that apply)

A. The following alternatives have been considered for this individual:

| Personal Care Serv. | Day Care | Pers. Care Home | |||

| Meals on Wheels | Phone Reassurance | RB&C Home | |||

| Congregate Meals | Friendly Visitor | Nursing Home | |||

| Homemaker | Care in Rel. Home | Group Home | |||

| Home Health | Adult Family Care | Institutional Care | |||

| Other (specify) | Other (specify) | Other (specify) |

B. I have concluded that the appropriate Social Services plan for this individual is For the following reason(s):

IV. ACTION WHEN SOCIAL SERVICE PLAN IS SUPERVISED CARE

A. General Information

- Date of Admission: 2. Level of Care: AFC RB&C PCH Inst

- Provider Address:

- Client Income will be managed by: Self Provider Other (specify on line below) Name: Address : Phone:

- Personal Expense Allowance will be managed by: Self Provider Other (specify on line below) Name: Address : Phone:

B. Client entered supervised care in another area

- Contact with receiving area made (date)

- Name and Title of staff person contacted

- If contact made after admission, explain

Additional Comments:

Signature of Social Worker Date Completed

Form G Adult Residential Corrective Action Letter

Bureau for Children and Families West Virginia Department of Health and Human Resources

(enter DHHR mailing address) (enter DHHR city, state & zip) Telephone: (304) (enter DHHR phone #) FAX: (enter DHHR fax #)

(Enter date notification sent)

(Enter name of facility administrator/operator being notified) (Enter Facility name ) (Enter mailing address) (Enter city, state & zip)

Dear (Enter name of person to whom notification being sent):

The Department of Health and Human Resources recently completed a review/site visit of your home/facility. During that visit, the following areas or concern were identified. Therefore, we are hereby advising you that you must prepare a Corrective Action Plan to address the areas of concern identified below:

(Enter all findings that must be addressed in the Corrective Action Plan)

The Corrective Action Plan is due to this office within 15 days following receipt of this notification. At a minimum, the Corrective Action Plan must: 1) address all the issues identified, 2) clearly identify the specific actions that are to be taken to correct the problem(s), 3) identify who is responsible for carrying out each task, and 4) specify the time frames for completion of each task.

DHHR District Address: Sincerely,

(Enter DHHR mailing address) (Enter mailing address) Name: (Enter social worker's name (Enter mailing address)

Title: (Enter social worker's title)

(Previously used SS-13)

WEST VIRGINIA DEPARTMENT OF HUMAN SERVICES

Dear